After three months where COVID-19 weighed heavily on the housing market, sales activity in June continued to show a significant improvement compared to the past several months.

Read the full June market report here: https://bit.ly/2VFziQZ

After three months where COVID-19 weighed heavily on the housing market, sales activity in June continued to show a significant improvement compared to the past several months.

Read the full June market report here: https://bit.ly/2VFziQZ

Cheers to our amazing clients for selling their home in Shillington! This is a very exciting time and we’re very happy for you. It was such a pleasure working with you to sell your house.

Congratulations to our client for selling her very special home at Hidden Creek Place! Thank you for the trust you placed in our team. This deal was done during Covid and the property was SOLD before it hit the market!

It was such a pleasure working with you to sell your home!

Very happy sellers! Congratulations on the sale of this beautifully renovated Willow Park home in just 3 days! So glad we were able to generate a quick successful sale for you. It has been such a pleasure working with you, and I wish you all the best in your next one

Get a chance to win a once-in-a-lifetime VIP RE/MAX hot air balloon flight for two. RE/MAX First presents you the ‘Above the Crowd!® with RE/MAX Contest. This contest will run from July 1st, 2020 to August 31st, 2020.

Read the full details here: https://bit.ly/AbovetheCrowdWithRemax

Watch the video here: https://bit.ly/RemaxAbovetheGround

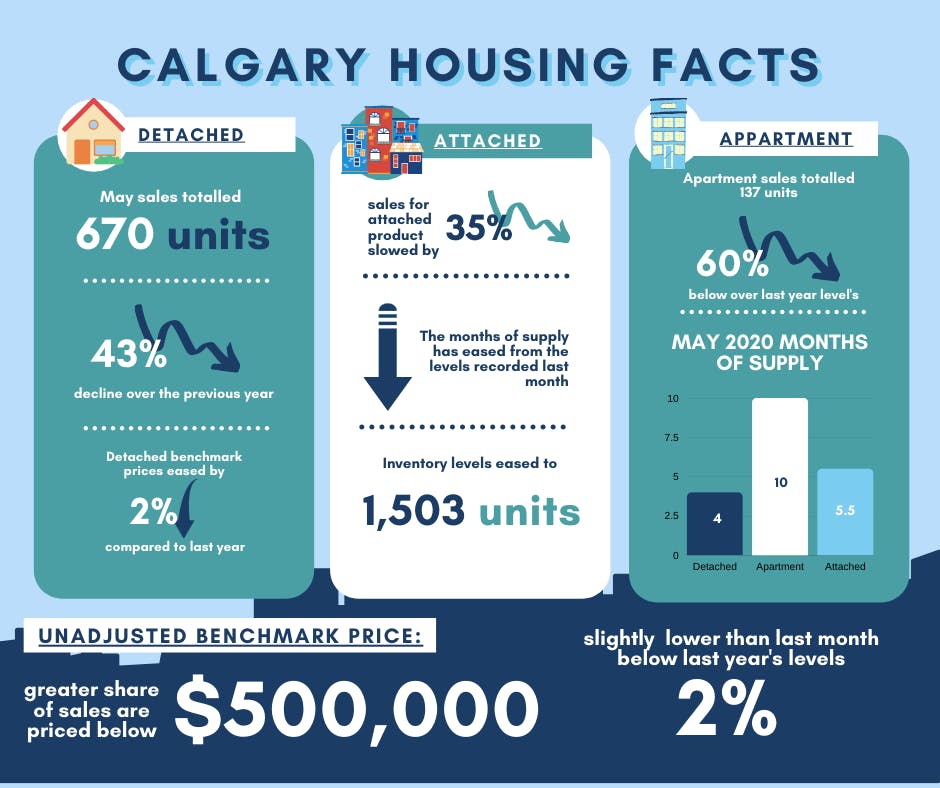

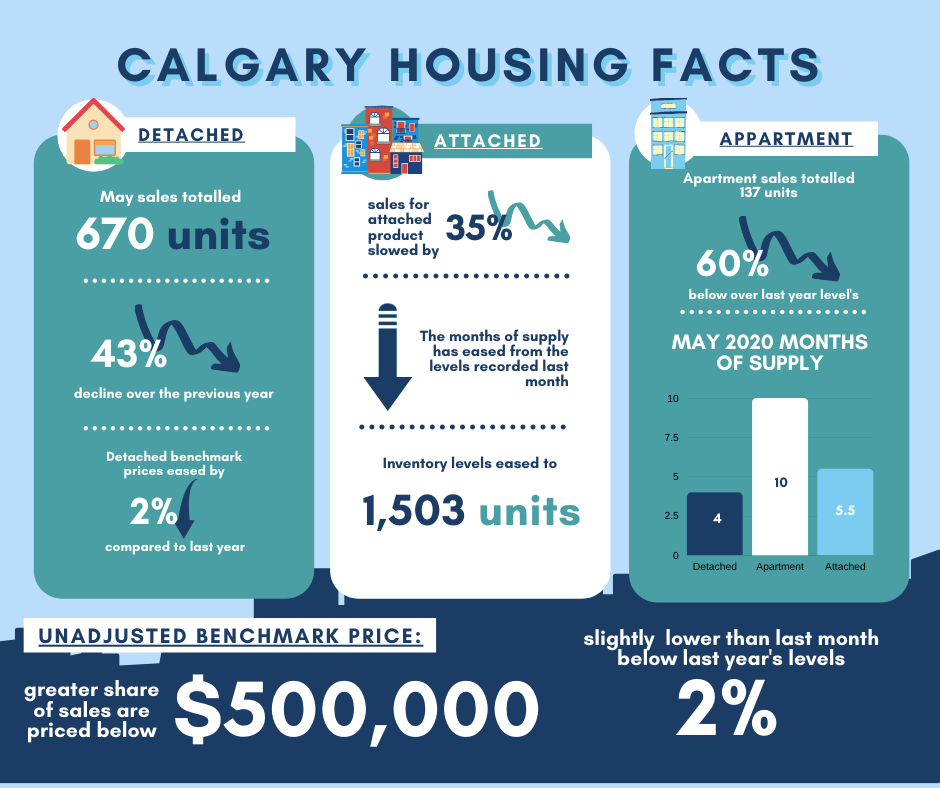

COVID-19 and social distancing measures have contributed to rising unemployment rates and job losses throughout many economic sectors. This is weighing on consumer confidence and the housing market. Click here for the full market report for the month of May: https://bit.ly/2XpEB8r

Housing market activity in May remained slow, but sales exceeded the lows from April, which saw less than 600 sales in Calgary. Click the video or read here to more about the COVID-19’s impact on the Calgary housing market: https://bit.ly/2XpEB8r

Thanks, Dan! It was a pleasure working with you in selling one of your investments. We pride ourselves in making sure every client receives personal attention and quick responses. I look forward to working with you again in the future.

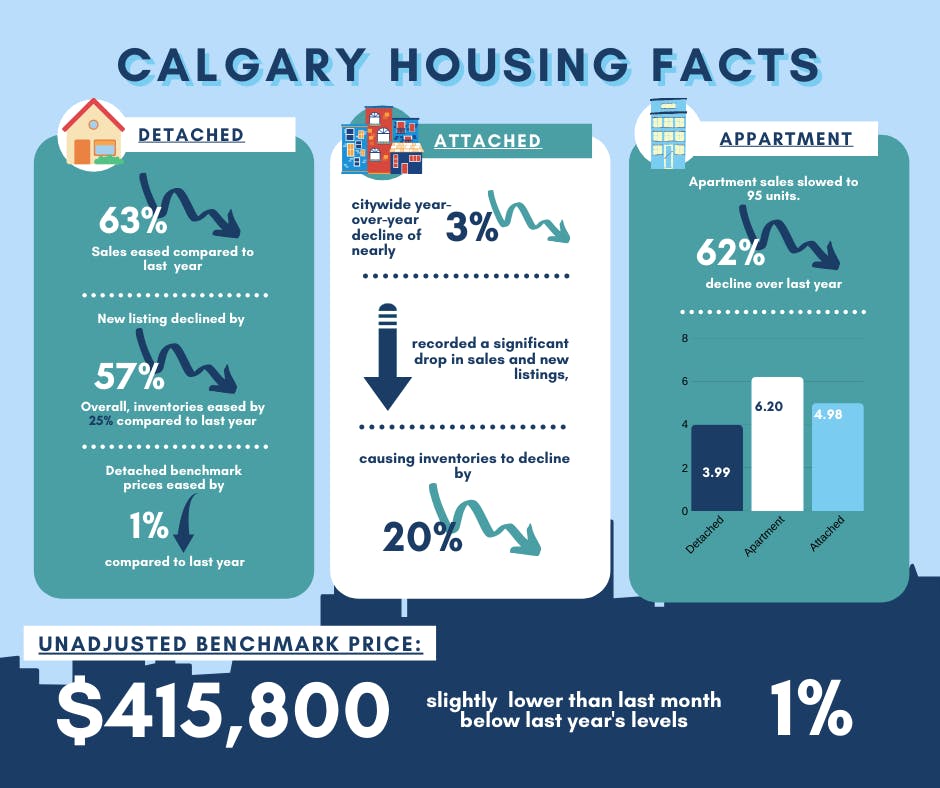

With the social distancing measures in place last April, the housing market is also adjusting to the effects of Covid-19.

Read here to know more: https://bit.ly/2AhzRIN

Clarence, I appreciate you allowing me to assist you in selling your property in these challenging times. I am grateful that we were able to achieve the result you were looking for. Thank you so much, and I look forward to working with you again in the future.

After the first full month with social distancing measures in place, the housing market is adjusting to the effects of COVID-19.

Watch here: https://bit.ly/3bv4g3k

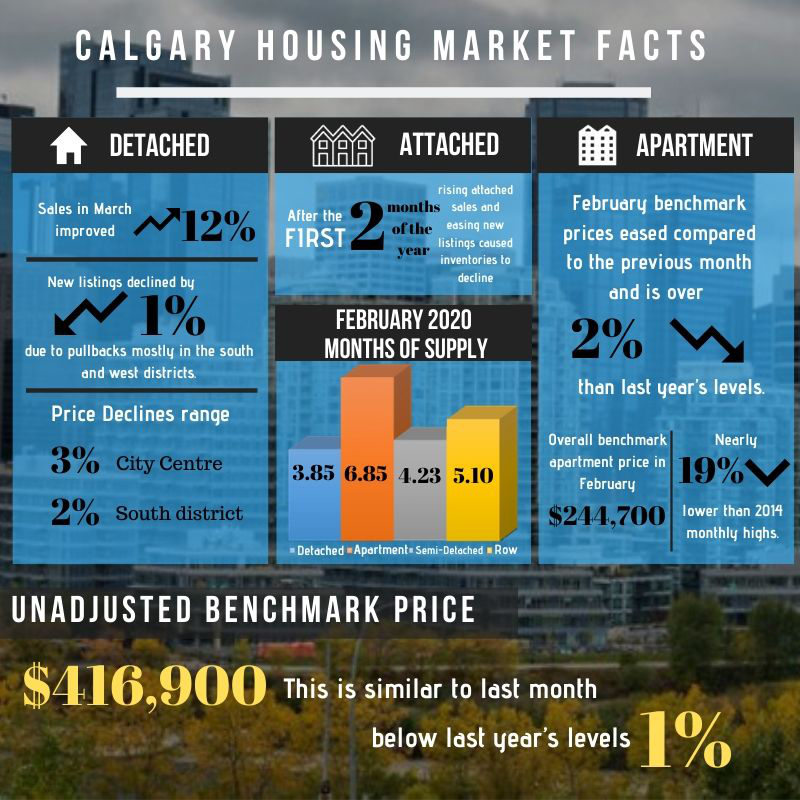

Despite experiencing a sales slump in February, the Calgary housing market is bouncing back this month.